Logan jailer considering appeal to open records decision

Published 8:15 am Wednesday, November 29, 2017

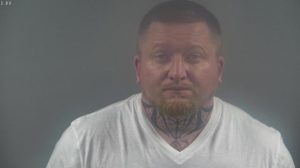

- Phil Gregory

Logan County Jailer Phil Gregory is considering appealing a Kentucky attorney general’s opinion that he violated the Open Records Act.

Logan County Magistrate Clem “Dickie” Carter filed an open records request that was first received by Logan County Fiscal Court. Logan County Judge-Executive Logan Chick gave the request to Gregory on Sept. 12.

Trending

Carter asked for “public records from the commissary account for the past” two years and included in his request a list of all checks and a list of all deposits written from the jail’s commissary account for the two-year period. In his request, Carter asked to be notified if there is any charge over $20 and he requested a waiver of all fees “in that the disclosure of the requested information is in the public interest … ,” according to Carter’s request.

Gregory responded Sept. 14 in writing that he had received the open records request and due to the volume of copies involved, the request would be filled in full on or before Sept. 28 because all of the documents would have to be reviewed and “all private information redacted.”

“It took a week to pull the records together,” Gregory said. “It was an enormous hardship on the staff in the front office to produce these records.”

On Sept. 26 during a fiscal court meeting, Gregory delivered the documents in the request – 31,679 pages – and also handed Carter an invoice for $4,633.30. The charges were explained as $3,167.90 for copies at 10 cents per page, and 76 hours of deputy wages and benefits totaling $1,465.40.

Carter left all of the documents in a storage room at the county courthouse and appealed Gregory’s handling of his request.

On Nov. 13, the attorney general’s office found that Gregory violated the Open Records Act by not disposing of the request in a timely manner or stating the specific state statute for the redactions made to the records.

Trending

The attorney general’s office also said Gregory subverted the intent of the act by charging copying fees and staff costs to make redactions before an inspection of records where copies were not requested, according to the opinion.

“Since Mr. Carter did not ask to receive 31,679 copies, the only legitimate purpose for making those copies was to provide him the records for inspection in redacted form,” read the attorney general’s opinion. “This being the case, the jailer’s attempt to impose a copying fee for mere inspection of public records was ‘legally unsupportable’ and subverted the intent of the Open Records Act, short of a denial of inspection, within the meaning of KRS 61.880(4). 07-ORD-013; see also 16-ORD-239. Mr. Carter should therefore be allowed to inspect the redacted copies without charge; the jailer may charge $.10 per page for copies only to the extent that they are requested by Mr. Carter.”

Gregory is considering an appeal to Logan Circuit Court. If he decides to appeal the attorney general’s opinion, he will be represented by Logan County Attorney Joseph Ross.

Between the request and Gregory’s efforts to fulfill it, Gregory said he spoke to Chick and told him that the jail had already made 2,000 copies of records as part of the effort to answer Carter’s request. Gregory said he would have gladly stopped making copies if Carter had at any point told him he didn’t want all of the information requested. Carter spoke to Chick before Gregory’s delivery of the records and Chick told Carter that he might want to call Gregory.

“He did mention, ‘I told Phil if this was going to be over $20, to notify me.’ I told him at that time, he might ought to call Phil because it was my understanding it was already over 2,000 copies, and he relayed to me, ‘You go to Phil’ and I said, ‘No, you go tell Phil because this doesn’t have anything to do with fiscal court, and I’m not going to be your message carrier anymore,’ “ Chick said.

Before the open records request, Carter tried to convince other magistrates to vote to have Gregory provide the records to fiscal court, Chick said. His motion failed in a 2-5 vote.

Carter said he wanted to see the records after two state audits pointed out deficiencies in keeping records of the jail’s commissary account.

The last audit noted “a lack of segregation of duties,” pointing out that, while the jail’s budget for staff is limited, the bookkeeper at the jail collects money, makes deposits, prepares daily checkouts, writes checks, prepares ledgers and reconciles the jail commissary account.

Other deficiencies noted with the commissary account were “caused by a lack of internal controls as well as a lack of experience by the new jailer and bookkeeper who lacked knowledge of accounting requirements under … standards” mandated by state law and the Department of Local Government.

The audit recommended the strengthening of internal controls over the jail commissary fund, with proper accounting records maintained through preparation of a daily checkout sheet, batching the receipts so that they agreed with the checkout sheet and making daily deposits.

The jail has since addressed those issues, Gregory said.

“We have a current audit going on right now, and those issues mentioned have been fixed. It was a segregation of duties and a couple of other things. They’ve all been fixed,” he said. “I’ve got four or five people counting the money that comes into the jail.”

When Gregory first became jailer in 2014, he was without an administrative assistant, a chief deputy or a Class D inmate coordinator. Accounting issues were not, at that point, his first priority, he said.

“I was focused on the fact that inmates could walk out the door of the jail unchallenged,” Gregory said. “My primary concern at the time was public safety. We secured the doors that they could walk out of and put up a security fence around the jail. There had been two escapes prior to me becoming jailer. That was priority one, was public safety.”

Staffing levels were in such bad shape, a neighboring jailer sent office staff to assist with front office obligations.

“There was nobody there to train us,” Gregory said. “We had a lot of catching up to do in the front office.

“In the audit report there was no criminal wrongdoing or any misappropriation of funds,” he said.

Carter said he does not intend to take possession of the copied records and never imagined that he would be given 31,679 pages. At this point, he doesn’t plan to read any of the records copied for him. Carter said he intended only to ask for the end-of-the-month bank statements of the commissary account.

“There is no way I can read all that stuff,” Carter said. “Who in the world would want 32,000 copies.”