Group urges backpedaling of state income tax cuts

Published 8:15 am Thursday, January 5, 2023

- The Kentucky Center for Economic Policy urges backpedaling of income tax cuts at a panel in the Frankfort State Capitol on Tuesday, Jan. 3, 2023.

FRANKFORT — On the first day of the 2023 legislative session, the Kentucky Center for Economic Policy held a panel imploring the General Assembly to backtrack on its planned income tax reductions.

House Bill 8, passed during the 2022 legislative session over Gov. Andy Beshear’s veto, cut Kentucky’s income tax rate from 5% to 4.5% beginning Jan. 1. House Bill 1 in the current session is set to affirm the change.

HB8 is the first step in a planned series of half percentage drops each year until the income tax is eliminated, provided that the state’s General Fund meets certain thresholds.

Republicans have said that the tax cut is designed to make Kentucky more competitive with neighboring states by reducing its reliance on income taxes in favor of more consumption-based taxes.

Income taxes make up 41% of the state budget, according to Natalie Cunningham, outreach director for the Kentucky Center for Economic Policy.

While HB8 includes over 30 previously exempt goods and services that will now be subject to a 6% sales tax in order to make up for lost revenue, Cunningham said it’s far from enough.

KyPolicy estimates that the initial half percentage cut will result in a $247.6 million General Fund net loss in the second half of FY23, and $487.6 million in FY24.

“Even after taking into account additional sales tax revenues from HB8, a cut down to 4% will result in $1.1 billion net loss in revenue by 2025,” which is more than Kentucky spends on all of its universities and community colleges combined, Cunningham said.

KyPolicy panelists argued that HB8 uses temporary surpluses caused by “aggressive” federal pandemic aid as an excuse to make a permanent change that will eventually catch up to the state in future funding decisions.

“We will either see big cuts to public services we all rely on, tax increases that will inflict higher taxes on the poorest of us, or both,” Cunningham said.

Cunningham was joined by Erin Doherty Copeland and Shelly Baskin on the panel, in addition to about a dozen supporters from across the state.

Baskin, a staff member at Murray State University and member of the United Campus Workers, said that the historic surplus could have been used to invest in something that better serves all Kentuckians, like affordable housing, natural disaster recovery, health or higher education, which was subject to 11 budgets cuts between 2008-2021.

“While we applaud the legislative efforts in the 2021-2022 budgets to begin to reverse the story, we know that HB8 will lead to a further erosion of an already bare bones public education system,” Baskin said.

“In a state where public higher education has traditionally been a pathway out of poverty, this represents a tragic and unacceptable attack on the working people of Kentucky.”

Erik Lewis, Morehead State University faculty member, echoed Baskin’s concerns. He said that when faculty ask about unfilled vacancies at MSU, they are told there isn’t enough money to fill them.

“So if the problem is a lack of funds, all of a sudden we have some, we have a surplus here,” Lewis said.

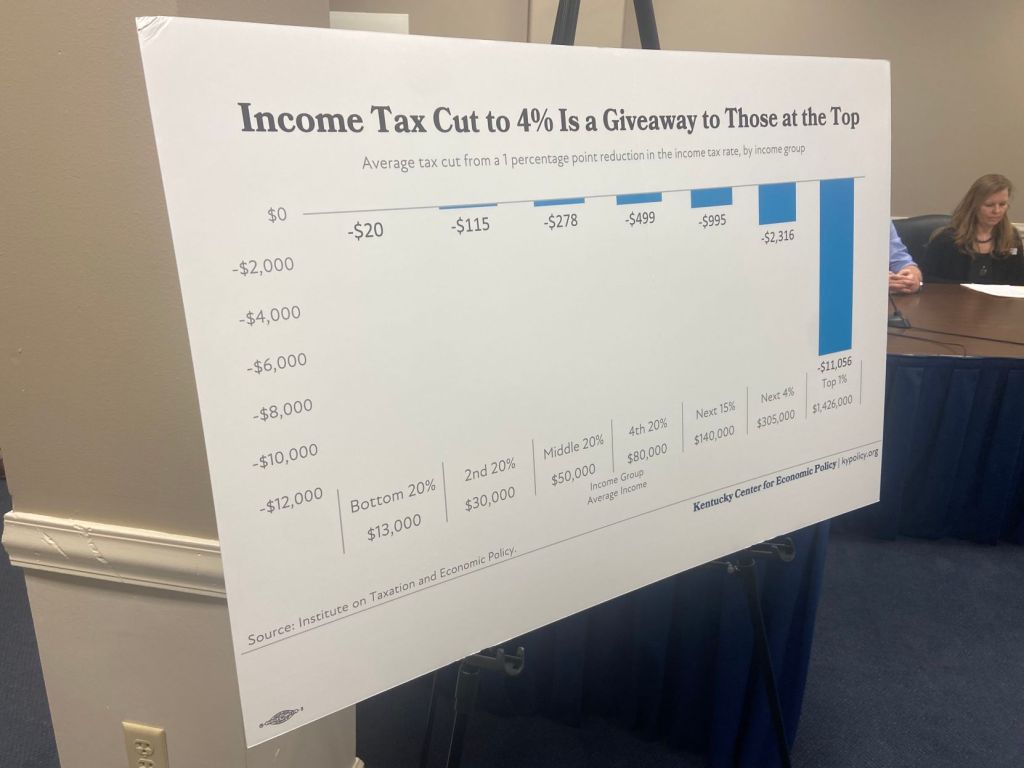

Copeland, a member of Kentuckians for the Commonwealth and psychotherapist, said that the tax cut will disproportionately hurt the poorest Kentuckians, who will receive a nominal amount of money from the tax cut that won’t make up for the sales tax they will have to pay on more services.

“Kentucky will be forced to make massive cuts to public education, Medicaid, the criminal justice system and other areas,” she said. “Slashing the income tax will not benefit the average Kentuckian, me or my family or those struggling the most. It will be another giveaway to those who have the most already.”

Carol Turpin, a former educator and inspector, came to support KyPolicy. She said that the tax cut is a rehashing of trickle down economics that doesn’t work.

“If you want money to cycle back through our economy, we have to have programs that pump it back to the people who are suffering and programs that help them get the education they need to climb out of poverty,” Turpin said.

It’s highly likely that KyPolicy’s pleas will hit deaf ears, as the Republican caucus has shown near-unanimous support of the income tax reductions to this point. However, Cunningham still has hope.

“We’re all people,” she said. “We’re all human. We all care about our communities and each other and there’s always a hope and a possibility for someone to see another side.”