Payroll protection: Local businesses tapping into loan program

Published 7:30 am Wednesday, April 15, 2020

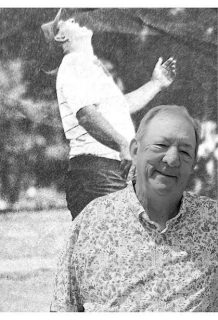

- Trent Ranburger and his mascot Lil' Trent of Trent Bedding pose for a photo in the Bowling Green store on Tuesday, April 14, 2020. Ranburger has applied for the Payroll Protection Program instituted by federal legislation aimed at providing relief from the disruption of the coronavirus pandemic.

Alvin Ford Jr. would rather be selling recliners and couches. Trent Ranburger would much prefer socializing with customers while they try out mattresses in his showroom.

But both local business owners instead find themselves, in this time of social distancing, joining a huge crowd that’s trying to navigate a federally created system designed to be a lifeline for businesses buffeted by the economic devastation of the coronavirus pandemic.

Trending

Ford, co-owner of Ford’s Furniture, and Ranburger, owner of Trent Bedding, have applied for loans through the Payroll Protection Program that is part of the $2 trillion Coronavirus Aid, Relief, and Economic Security Act passed by Congress on March 27.

And, much like the economy itself, both businessmen are on hold waiting for the money in the form of U.S. Small Business Administration forgivable loans designed to cover the payroll expenses of small businesses for eight weeks.

“We signed up for it, but we haven’t received anything yet,” Ford said. “They (the government) have us closed, so we had to apply.”

Along with just about every other small business – defined by the SBA as those having fewer than 500 employees – in the country, it seems. Michael Ashcraft, senior area manager for the SBA’s Kentucky District Office in Louisville, said Tuesday that about 4,500 lenders across the country had received more than 880,000 PPP loan applications for more than $215 billion.

“Those are incredible numbers,” Ashcraft said. “There’s no breakdown by state, but things are extremely active in Kentucky.”

That hyper-activity has led to what could be called the second outbreak caused by the coronavirus – this one a spate of loan applications coming from businesses hamstrung by the social distancing mandates that can make it impossible for them to conduct commerce.

Trending

Created in a rush as unemployment applications exploded, the PPP has had issues with the SBA’s electronic system for processing loan applications, called E-Tran, leaving many lending institutions frustrated as they try to help business owners apply for loans.

“Everything isn’t running smoothly,” Ashcraft said. “Many lenders have had trouble accessing the program.”

One local lender, American Bank & Trust President Tony Salyer, was a bit more candid, saying: “They’ve asked us to fly an airplane that hasn’t been built yet.”

Ashcraft insists the PPP is getting airborne, with “a trouble-shooting team helping get lenders online,” and business owners like Ranburger said the program has merit if the kinks can be worked out.

“I see it as a good thing,” said Ranburger, who said he has so far been paying his five employees out of the store’s savings. “I just hate the fact that it has to be used.”

Ashcraft calls the PPP “very straightforward” in its goal of keeping employees on the payroll of small businesses.

After they calculate their average monthly payroll, business owners apply for a loan to cover two months of payroll.

“They can use it all for payroll expenses, and they can use it for rent or mortgage payments,” Ashcraft said. “It will enable them to pay people through June 30, and the full amount of the loan will be forgiven if at least 75 percent of the loan is used for payroll.”

Ford calls the PPP “a wonderful concept” that will allow his 40 employees to avoid further unemployment insurance filings. That very attractiveness, though, might be part of the program’s problem.

The PPP was allocated $350 billion in the CARES Act, and already members of both houses of Congress are saying that wasn’t enough.

“Congress probably fell a little short,” said Rebecca Stone, president and CEO of Bowling Green’s Service One Credit Union. “They’re probably going to have to do some other things.”

Ashli Watts, president and CEO of the Kentucky Chamber of Commerce, agrees that more federal funding is needed to adequately prop up the businesses that are lining up to apply for the PPP. But she said that’s not a long-term solution to the economic woes brought about by the coronavirus.

“Money is running out, so I do expect in the near future that Congress will put more money into that program,” she said. “The business community has been resilient, but it’s time to start talking about coming out of this.”

Coming out of what amounts to a shutdown of the nation’s economy is a priority for Ford and Ranburger, who both said they would like to see restrictions on businesses lifted May 1.

Although he has no firm date in mind, Western Kentucky University professor of economics Brian Strow said a return to normal economic activity is a must.

“The longer the economy remains shut down, the larger the odds are that any given small business will fail,” Strow said. “No business can continue to operate indefinitely without generating revenue.”

An extended economic hiatus could also mean a greater reordering of the nation’s economy as consumer habits change.

“Already we are seeing a large gap open up between businesses that are allowed to operate and those that aren’t,” Strow said. “Larger, more solvent businesses will get even bigger. Smaller mom-and-pop businesses will continue to be squeezed out.

“The post-virus world will see the pace of online retailing increase even faster at the expense of brick-and-mortar stores. Higher levels of consumer debt may have a sizable impact on large purchases such as automobiles and homes.”

– Follow business reporter Don Sergent on Twitter @BGDNbusiness or visit bgdailynews.com.