Hart County Schools gets $793,000 via energy-savings project

Published 8:21 pm Thursday, December 26, 2024

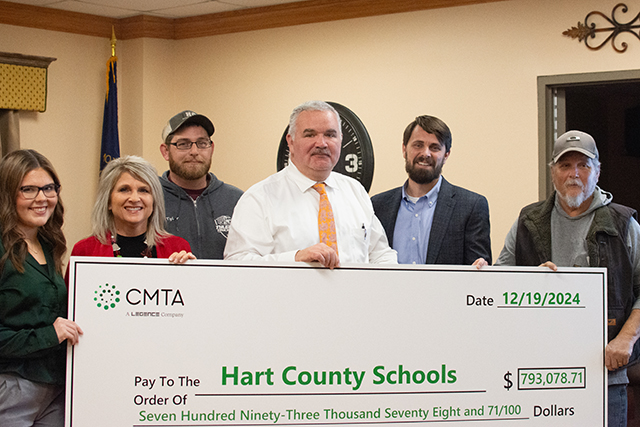

- Hart County Schools Student Representative Emma Sanders, HCS School Board Vice Chairman Tina Rutledge, HCS School Board Member Tyler Holthouser, HCS Superintendent Nathan Smith, CMTA Project Manager Jason Pollan and HCS School Board Member Wesley Hodges pose for a picture with a $793,078.71 ceremonial check at the school board’s Thursday meeting, representing funds of the same amount earned through the installation of a geothermal well field.

Hart County Schools has earned $793,000 by installing a field of geothermal wells — technology that, because it utilizes renewable energy, has enabled the district to acquire tax credits.

HCS qualified following its August 2023 installation of its heat pump system at Memorial Elementary School. It was one of numerous guaranteed energy-savings projects HCS has undertaken with CMTA, a leading engineering and sustainable building design firm headquartered in Louisville.

CMTA Project Manager Jason Pollan made these announcements and presented a ceremonial check for the tax credit reimbursement to the HCS school board at the latter’s meeting last week.

Trending

In addition to the tax credits, the energy-savings projects have saved HCS about 52% on utilities — an additional $283,000 — in the last year, Pollan said. Halving utility bills via this energy performance contract with CMTA will save HCS $6.7 million over 20 years, HCS Superintendent Nathan Smith said in a statement.

The $793,000, specifically, was acquired by HCS for the well field through the 2022 Inflation Reduction Act (IRA), a landmark energy policy that expanded which technologies qualify an entity for tax credits.

Normally, nonprofits and public entities such as schools don’t qualify for tax credits because they don’t have a tax liability. But an IRS feature known as elective pay, incorporated under the IRA, allows these clean energy tax credits to be claimed by school districts.

HCS is one of the first districts nationwide to receive funding in this way, according to a press release.

“Hart County is among a leading set of districts across the country that are leveraging clean energy tax credits to reduce costs for taxpayers,” stated Sara Ross, cofounder of the national nonprofit UndauntedK12, which has spread awareness about how to make buildings more cost effective and able to adapt to the climate crisis.

CMTA began working with HCS more than three years ago, Pollan said. The energy improvements — which span seven buildings across 421,800 square feet — include completing HVAC renovations at four buildings; replacing 2,600 fluorescent lighting fixtures with LED lighting; installing web-based building automation systems across five schools for energy management; and envelope improvements at four buildings to enhance insulation and energy efficiency, according to the release.

Trending

The well field, which replaced a traditional gas-fired boiler and cooling tower, entailed the installation of more than 400-foot wells 20 feet apart connected by tubing, Pollan said. During summer, it pulls heat out of the building and stores it in the ground; in the winter, it transfers the heat from the ground into the building, he added.

CMTA recognized the tax credit opportunity in August 2022, when the design of the Memorial Elementary School well field was complete, and construction had started, Pollan said.

CMTA found an accounting firm that would file taxes for a nominal fee, Pollan said. It conducted a Cost Segregation Analysis where it identified funding specifically used on the well field, he added; a percentage of the total construction cost would go toward the tax credit funds.