Lawsuit: Inmates’ checks taken

Published 6:00 am Saturday, December 24, 2011

Deputy jailers at the Warren County Regional Jail endorsed checks of at least two inmates and deposited them into a bank account kept by the jail without the inmates’ knowledge or permission, according to claims made in a class-action lawsuit filed in federal court.

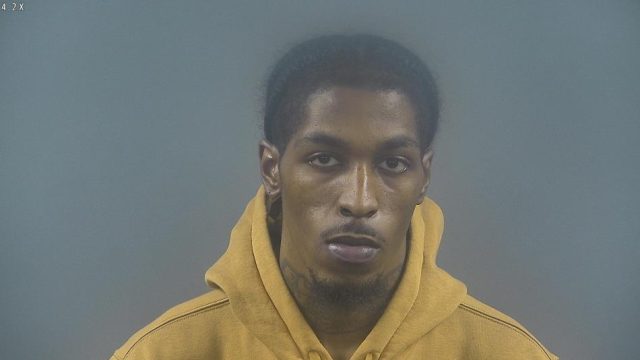

The suit, which was filed in U.S. District Court in Bowling Green on Dec. 12, alleges that Stuart Cole and Loren Patterson had their constitutional rights to due process and against unlawful search and seizure violated when they were jailed.

Trending

The complaint names the county, Warren County Jailer Jackie Strode and four current or former deputies – Jeff Robbins, Pat Watt, Misse Cooper-Edmonds and Gayle Eston – as defendants, along with Warren County Judge-Executive Mike Buchanon, South Central Bank of Bowling Green, bank chair Ellen Lee Bale and bank President Tommy Ross.

According to the complaint, Cole and Patterson possessed checks made out to them when they were arrested, along with cash and other personal property.

While the checks, cash and other personal effects were taken from them as is customary when the jail processes inmates, jail employees endorsed the checks with a stamp reading “For Deposit Only, Warren County Jail, Inmate Account” and deposited them into an account at South Central Bank, the lawsuit said.

Records on the jail’s website indicate that Cole was jailed in 2009 after being arrested on charges of operating a motor vehicle while under the influence and reckless driving, while Patterson was jailed in September following an arrest on a DUI charge. Both men were booked and released the same day as their arrest.

“We have the canceled checks … we’re not sure where that money goes or what it’s used for, but I think you would have a pretty serious problem if someone took a check out of your wallet and cashed it without your endorsement or knowledge,” said Greg Belzley, a Louisville attorney representing both men.

Belzley said the lawsuit is meant to raise questions about whether inmates owe money to the jail before being found guilty or pleading guilty to a crime and whether the jail is justified in taking checks in the manner the lawsuit claims.

Trending

“This money is being deducted automatically without regard to any adjudication of guilt,” Belzley said. “One can imagine situations where someone was arrested for a crime they didn’t commit or arrested on the basis of mistaken identity, and there’s absolutely no grounds for those people having money taken from them without their consent to pay for court costs that can’t be levied against them.”

Bowling Green attorney Gary Logsdon is also representing Cole and Patterson in the civil case.

Logsdon said Patterson was a student at Middle Tennessee State University and was visiting a friend at Western Kentucky University over Labor Day weekend when he was arrested.

Patterson had a check for $150 made out to him from his parents meant to buy textbooks, Logsdon said.

At the time of Cole’s arrest, he had two checks made out to him from his girlfriend’s account totaling $259.95, payments for money she had previously borrowed from Cole, Logsdon said.

“(The jail) just take the checks and stamp their endorsement on them and let her fly, and the bank lets them credit it to their account,” Logsdon said.

Online records with the U.S. District Court for Western Kentucky show that no response has been filed to the original lawsuit and no attorney is listed for the county or any of the other defendants.

Belzley said the defendants have 20 days from the date of the original lawsuit to file a response.

Strode declined to comment specifically on the lawsuit.

However, Strode said it’s standard practice that when inmates with cash or checks in their possession are brought to the jail for processing, the funds are placed in an inmate account that can be used to buy snacks, soft drinks or other jail commissary items. “When they are released they can come to the jail or call the jail and request any unspent money be refunded to them,” Strode said.